< Previous | Contents | Next >

DEBT SERVICE FUNDS

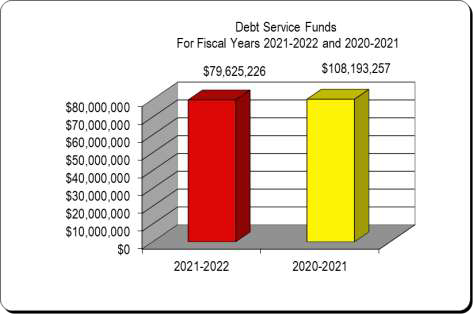

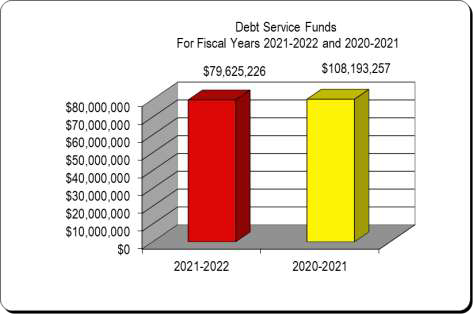

The 2021-2022 budget for the Debt Service Fund is $79,625,226, a decrease of $28.6 million or 26.40% below the 2020-2021 budget due to the terms of financing agreements and principal and interest payments.

The Debt Service Fund is used to account for the accumulation of resources for, and payment of, general long-term debt principal and interest. The District currently combines debt service funds into four groups as follows:

State Board of Education Bond Funds - used to account for principal and interest payments for various bonds issued

by the State of Florida on the District’s behalf.

Capital Improvements Revenue Bond Funds - used to account for payments on Motor Vehicle License Tax Revenue Bonds, which are secured by racetrack funds and Jai Alai Fronton funds received annually by Pasco County.

Sales Tax Bond Funds - used to account for payments on the Sales Tax Bond, which is secured by forty-five (45) percent of the one (1) percent voter approved sales tax.

Certificate of Participation Funds - used to account for payments for obligations pertaining to lease payments from debt issued under a Master Lease Agreement with the Pasco County Leasing Corporation.

Lease-Purchase Contracts – used to account for the obligations pertaining to lease payments for computer, iPads, buses and service vehicles issued under a lease-purchase agreement.

The District must repay debt service prior to making any other expenditures. The principal and interest payments for fiscal year 2021-2022 are listed below:

Debt Service Type | Principal | Interest/Fees |

Certificates of Participation Notes | $ 16,079,083 | $ 15,351,377 |

State Board of Education Bond Funds | 723,000 | 200,520 |

Sales Tax Bond Funds | 18,635,000 | 2,704,971 |

Capital Improvement Revenue Bonds | 55,000 | 146,025 |

Lease-Purchase Contracts | 11,022,357 | 560,413 |

Total | $ 46,514,440 | $ 18,963,306 |